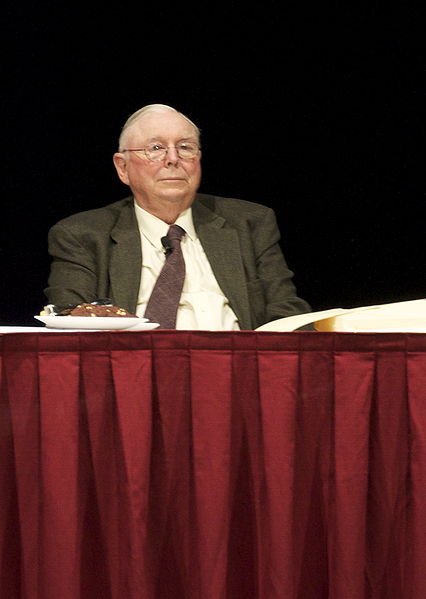

The realm of finance is draped in mourning as it bids adieu to one of its most venerable figures, Charles Thomas Munger, who departed this world on November 28, 2023, at the age of 99. A luminary, an iconoclast, and the trusted confidant of Warren Buffett, Munger’s influence transcended the boundaries of business, leaving an indelible mark on the world of investing and beyond.

Early Life and Friendship with Buffett

Born on January 1, 1924, in Omaha, Nebraska, Munger’s early years were interwoven with the fates of the Buffetts. Attending the same high school as Warren Buffett and working at his grandfather’s grocery store, their paths converged in their 30s, birthing one of the most storied partnerships in financial history. United by a shared vision and values, they built Berkshire Hathaway into a conglomerate that defied norms and set precedents.

Architect of Berkshire’s Triumph

Munger’s influence on Berkshire Hathaway was nothing short of transformative. His mantra, “buy wonderful businesses at fair prices,” revolutionized Buffett’s investment approach. The Berkshire we know today, with its diverse portfolio ranging from Coca-Cola to Apple, stands as a testament to Munger’s strategic brilliance.

A Legacy Beyond Finance

Munger’s wisdom extended far beyond the realms of finance. His ‘latticework’ of mental models advocated for continuous learning. Munger’s speeches, often distilled in “Poor Charlie’s Almanack,” became a compass for those navigating the complexities of business and life. His thoughts on investment, success, and the art of clear thinking became guiding principles for many.

Quotes That Defined an Era

Charlie Munger’s wit was encapsulated in succinct, yet profound, quotes that resonated with investors and thinkers alike. His reflections on learning, success, and embracing a lifelong curiosity became beacons for those charting their course through the intricacies of life and business.

A Remarkable Life Beyond Finance

Munger’s life was a tapestry woven with threads of triumph and tragedy. Personal losses, including the passing of a son and a grave eye injury, were met with resilience and an unyielding commitment to life’s journey. His second marriage, enduring for 54 years, was a testament to his belief in enduring partnerships.

A Timeless Legacy

As we bid farewell to Charlie Munger, we celebrate not merely the man but the enduring legacy he leaves behind. His teachings, his principles, and his unwavering commitment to wisdom and learning will continue to resonate across boardrooms, classrooms, and the minds of those inspired by his remarkable journey.

In the tapestry of time, Charlie Munger’s thread remains, weaving through the annals of financial history, a testament to a life extraordinarily well-lived.

Charles Thomas Munger (1924-2023)

Read More:

The Real Estate Millions of Ben Mallah

7 Business Leaders Whose Antics Have Americans Buzzing

Can Dairyfree Milk Be Worth Millions? Here’s What The Founders of Numilk Are Worth