The 1960s – a time of bell bottoms, flower power, and moon landings. But beyond the iconic trends, it was a period full of events that shaped history, and we continue to feel the consequences of today. Grab your lava lamp as we look at 20 unforgettable 1960s events that changed history!

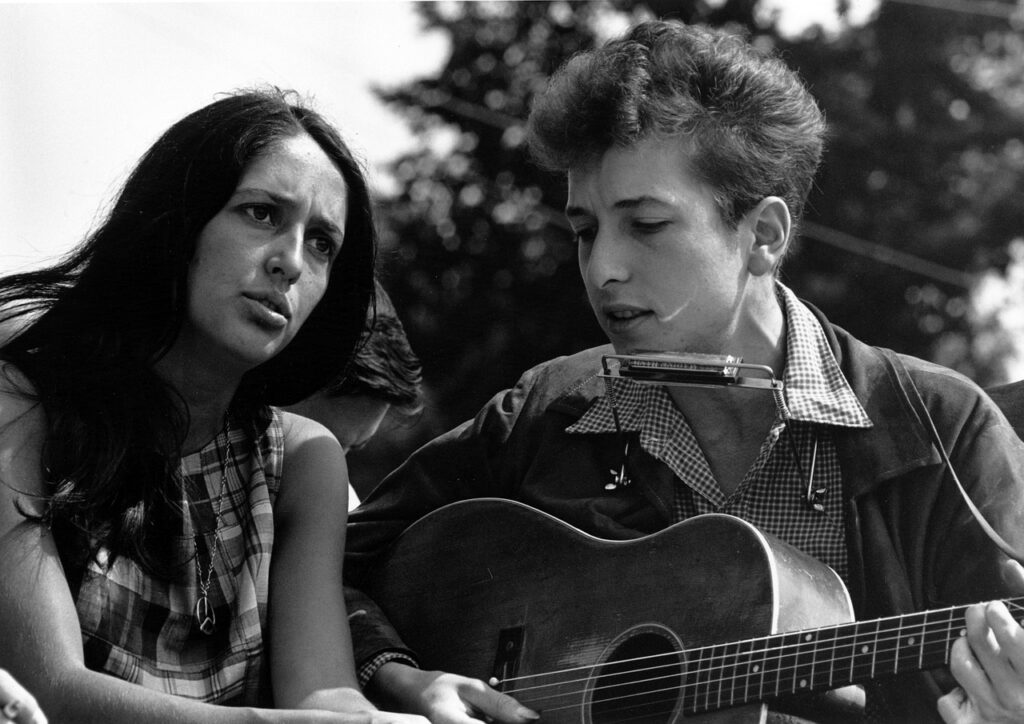

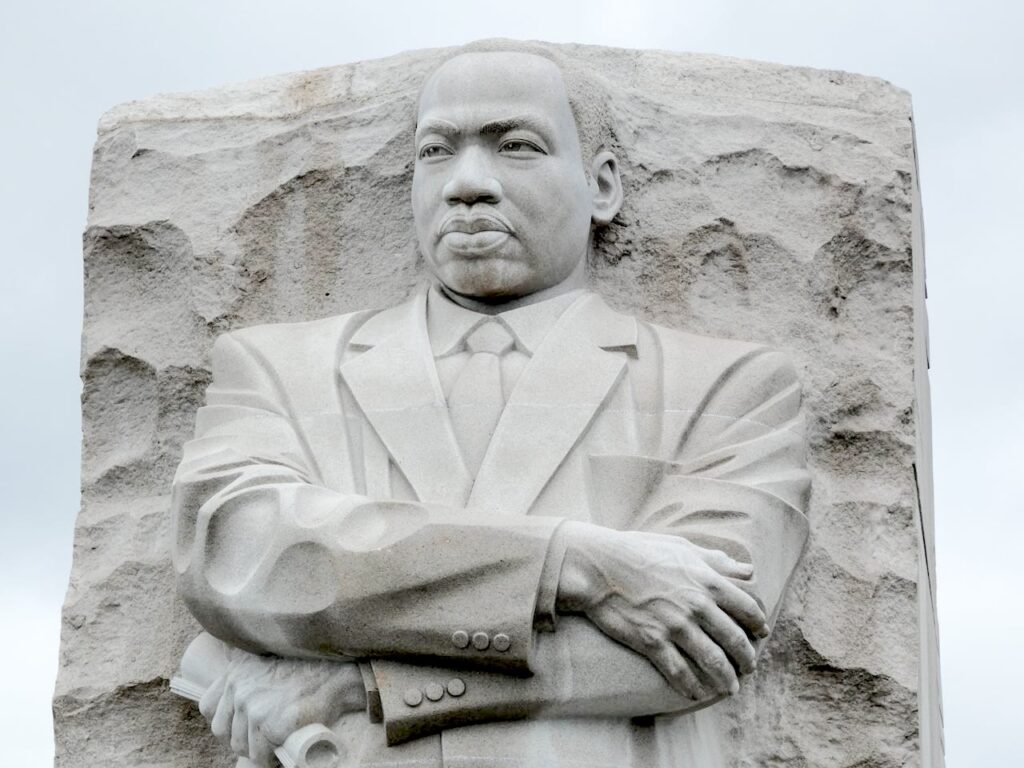

1. The Civil Rights Movement Marches On

The fight for racial equality in America became very important throughout the 1960s. Martin Luther King Jr.’s powerful speeches, like the iconic “I Have a Dream” address at the March on Washington, and peaceful protests, like the Selma to Montgomery marches, challenged segregation and discrimination. This helped dismantle Jim Crow laws and pave the way for the Civil Rights Act of 1964 and the Voting Rights Act of 1965.

2. The Berlin Wall Is Constructed

In 1961, the communist government of East Germany created a wall dividing Berlin, effectively turning a bustling city into two separate worlds. Families were torn apart overnight, and the wall became a chilling symbol of the Cold War. News broadcasts showed East Germans desperately trying to escape over the wall, showing just how divided Europe had become.

3. The Twist Goes Global

Chubby Checker’s dance craze, the Twist, took the world by storm in the early 1960s. Forget complicated routines – the Twist was all about shaking those hips and having fun! Dance crazes weren’t new, but the Twist went beyond age and cultural barriers. From American teenagers to Japanese office workers, everyone was doing the Twist!

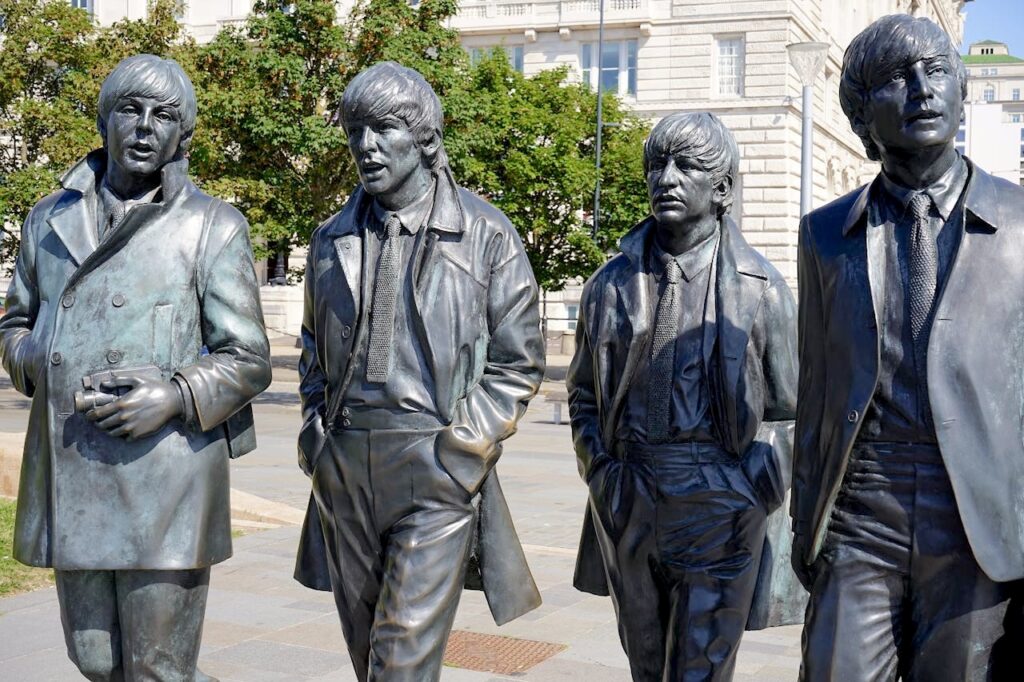

4. Beatlemania Erupts

The Fab Four’s arrival in America in 1964 sent teenagers into a frenzy. Their catchy tunes, like “I Want to Hold Your Hand” and “She Loves You,” topped the charts, and their mop-top haircuts and undeniable charm began the era of crazed fans. Beatlemania launched a British invasion and forever changed the music industry.

5. The Summer of Love Blooms

In 1967, San Francisco’s Haight-Ashbury district became the center of a counterculture movement focused on peace, love, and psychedelics. The “Summer of Love,” with its flower power symbolism, was a rejection of social norms. Although this experiment was short-lived, it left a lasting impact on fashion and social consciousness.

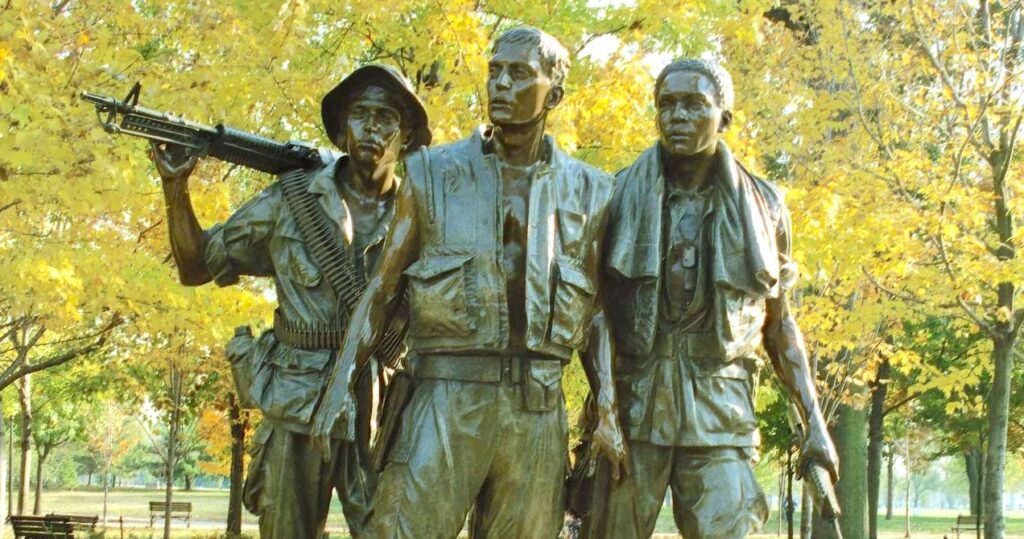

6. The Vietnam War Escalates

The U.S. became more involved in the Vietnam War during the 1960s. Troop deployments skyrocketed, with the number of American soldiers in Vietnam reaching over half a million by 1968. Newsreels filled with images of fierce fighting and growing casualties led to growing public unhappiness with the war.

7. The Equal Pay Act is Signed

In 1963, President Kennedy signed the Equal Pay Act, which prohibited wage discrimination based on gender. Naturally, it was a major victory in the fight for women’s equality. The Equal Pay Act helped to close the gender pay gap and helped to kickstart further advancements in women’s rights.

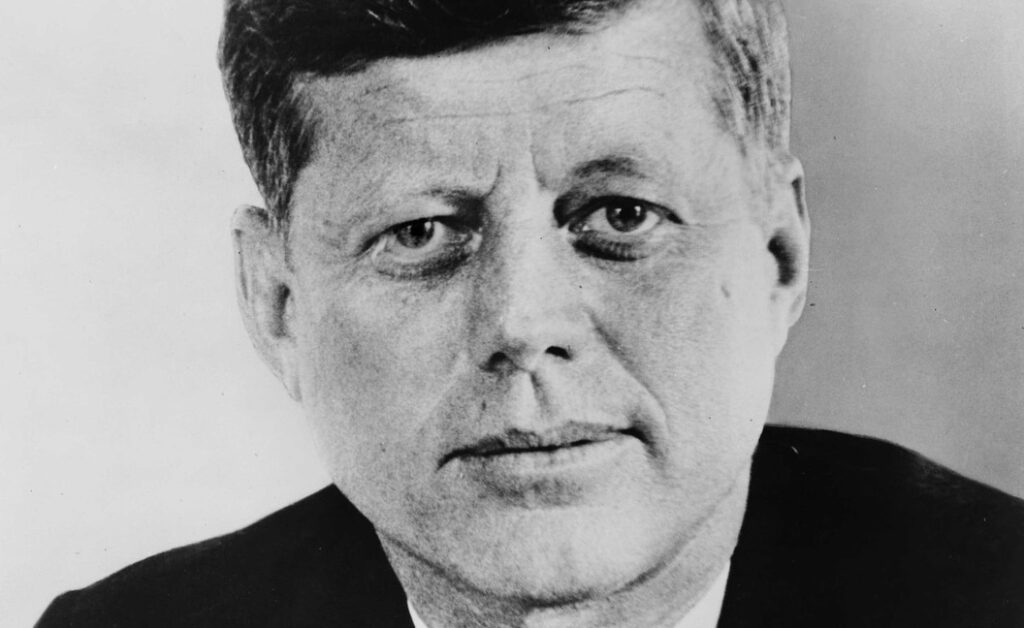

8. The Assassination of JFK

John F. Kennedy’s assassination in 1963 sent shockwaves around the world. The young, charismatic president’s death on live television left a nation reeling while conspiracy theories swirled. His assassination symbolized the end of an era of optimism and began a period of uncertainty and national grief.

9. The Mod Movement Takes Off

London’s mod subculture, known for its sharp suits and scooters, began in the mid-1960s. The mods rejected the traditional styles of their parents’ generation, embracing clean lines, geometric patterns, and bold colors. Like Beatlemania, this signature look soon took over the world.

10. The Stonewall Riots Ignite Change

A police raid on a gay bar in New York City’s Greenwich Village in 1969 began the Stonewall Riots, which was very important in the fight for LGBTQ+ rights. The Stonewall Riots led to the creation of gay rights organizations and a rise in activism, eventually shaping today’s more inclusive and accepting society.

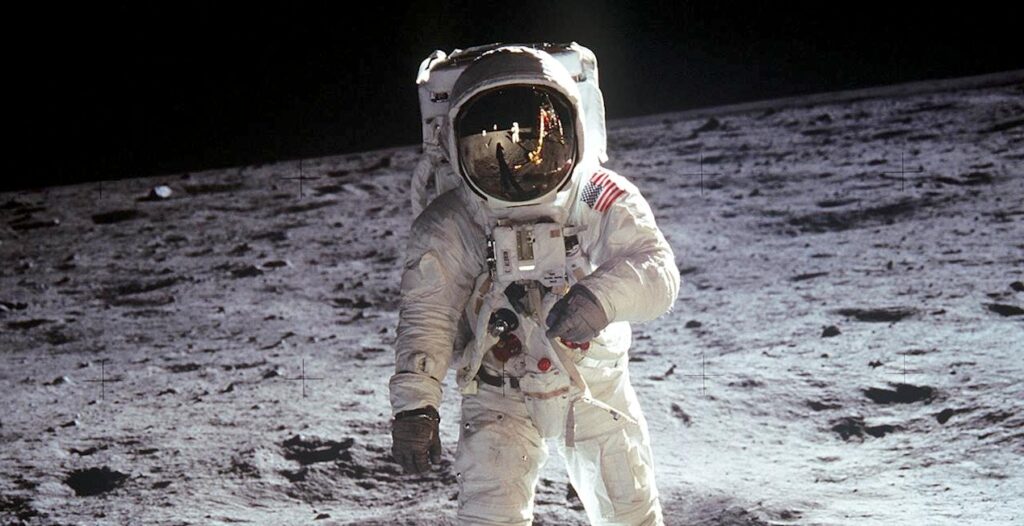

11. Apollo 11 Makes Giant Leaps

In 1969, the world watched as Neil Armstrong took “one small step for man, one giant leap for mankind” on the lunar surface. This monumental achievement in human space exploration helped start our journey into the stars. When Neil said it was a “giant leap for mankind,” he wasn’t lying!

12. Woodstock Music Festival Rocks On

The 1969 Woodstock Music Festival was three days of peace, love, and music. Renowned artists like Jimi Hendrix and Janis Joplin performed for hundreds of thousands of counterculturists. While the festival aimed for 200,000 attendees, an estimated half a million music lovers showed up, creating an unforgettable music experience.

13. The Mini Skirt Makes a Big Splash

Mary Quant’s trendy miniskirt became a fashion sensation in the mid-1960s. This daring piece of clothing challenged traditional ideas of femininity and began a fashion revolution. Yes, miniskirts showed more leg, but they were also a symbol of youthful rebellion and a break from the restrictive styles of the past.

14. The Barbie Doll Gets a Career

In 1963, Mattel introduced “Career Barbie,” a new version of the popular doll dressed in a doctor’s uniform. This edition challenged traditional gender stereotypes and encouraged young girls to dream big. Whether it was Doctor Barbie, Astronaut Barbie, or Firefighter Barbie, these dolls showed young girls they could be anything they wanted to be.

15. The Environmental Movement Takes Root

Rachel Carson’s groundbreaking book Silent Spring, published in 1962, raised awareness of the dangers of pesticides and began the modern environmental movement. This book inspired a generation to support a cleaner planet. Soon enough, “Silent Spring” was a wake-up call to the dangers of unchecked pollution.

16. The Peace Corps Promotes Global Change

Created in 1961 by President Kennedy, the Peace Corps sent volunteers abroad to work on development projects. Peace Corps volunteers lived alongside other people, learning new languages and breaking down barriers. However, they also had to deal with language barriers and unfamiliar customs, along with some conflict from the locals.

17. The Muhammad Ali KO Heard Around the World

Boxing legend Muhammad Ali’s stunning knockout victory over Sonny Liston in 1964 made it clear that he was the world’s heavyweight champion. Ali’s lightning-fast “phantom punch” left Liston sprawled on the canvas in the first round, shocking the boxing world. Ali was also a charismatic and outspoken figure who became a symbol of social justice.

18. The Super Bowl Debuts

The first-ever Super Bowl, held in 1967, pitted the Green Bay Packers against the Kansas City Chiefs. This historic game marked the beginning of America’s obsession with professional football. While the game itself was a close one (the Packers won 35-10), the real star of the show was the halftime entertainment – a marching band!

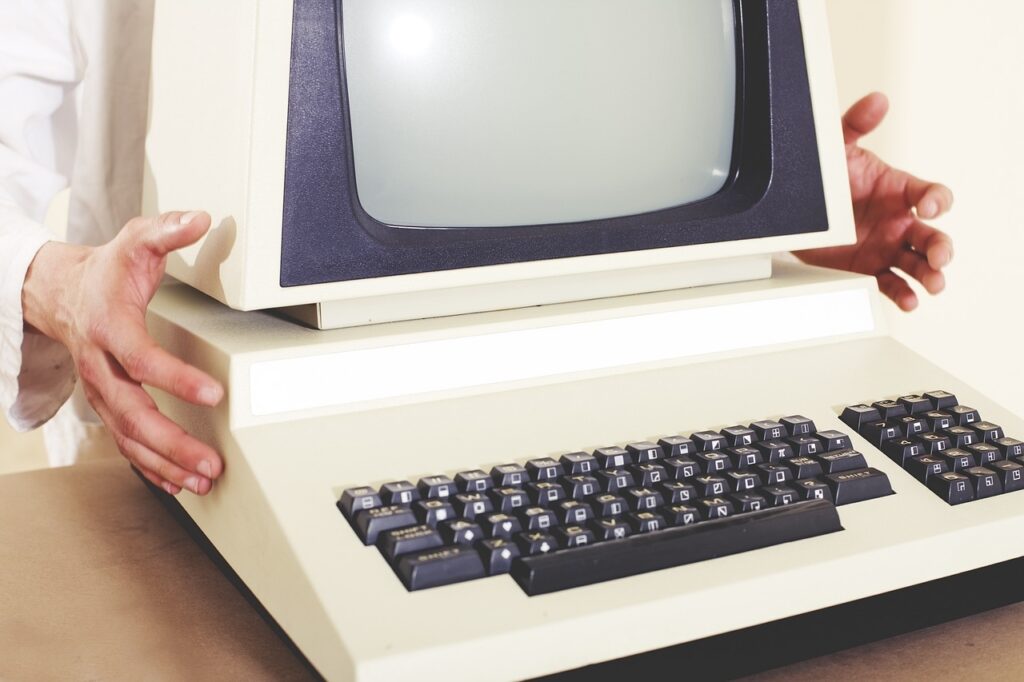

19. The Computer Revolution Begins

The development of the IBM System/360 in 1964 was a significant step forward in computer technology. It wasn’t exactly a sleek desktop computer! But this machine’s ability to handle a wide range of tasks laid the groundwork for the development of smaller, more user-friendly computers that would eventually change the world.

20. The Rise of Drive-In Movie Theaters

The 1960s saw the golden age of drive-in movie theaters. These open-air cinemas were a unique and affordable way to catch the latest films from the comfort of your own car. Soon enough, they became popular hangout spots for teenagers, offering a social experience alongside the movie. They were also family-friendly destinations, with playgrounds and concession stands keeping everyone entertained.

Historical Moments

So there you have it – 20 unforgettable moments that defined the groovy and history-changing 1960s! From the fight for civil rights to the birth of the computer revolution, this decade was a time of complete transformation. Even today, we can still feel the effects of many of the events as they shape our world in countless ways.

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.