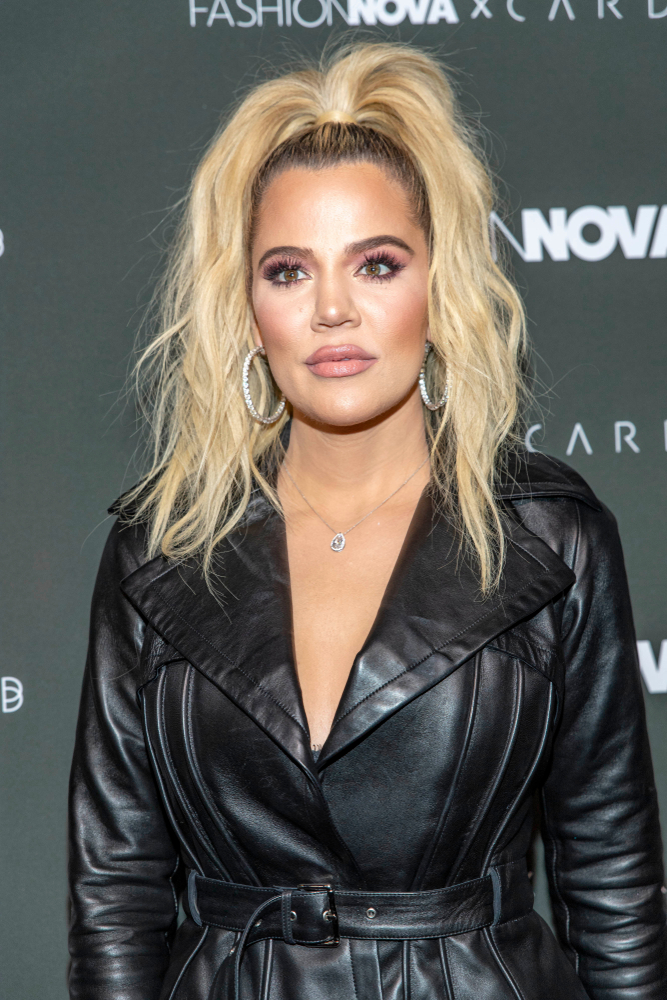

Khloé Kardashian has never been shy about expanding her empire, but her latest venture might be her most unexpected yet. The launch of her new Khloé Kardashian popcorn brand has fans, investors, and everyday shoppers buzzing about what this means for her growing fortune. This surprising pivot into the snack aisle shows how celebrities are increasingly tapping into everyday consumer habits to build long-term wealth. For readers trying to understand how high-net-worth individuals diversify their income streams, Khloé’s move offers a real-time case study worth watching. And if you’re looking for inspiration on how to build multiple income pillars of your own, this entrepreneurial twist delivers more than just a tasty snack.

A Strategic Pivot Into a Booming Snack Market

Khloé’s decision to launch a Khloé Kardashian popcorn brand isn’t just a fun celebrity side project—it’s a calculated business move. The snack industry has exploded in recent years, especially with health-conscious consumers seeking better-for-you options.

By entering a market already projected to grow steadily, Khloé positions herself to capture both impulse buyers and loyal fans. Her brand leverages her existing influence while tapping into a product category that sells year-round, recession or not. This combination of timing, branding, and consumer demand makes the pivot far more strategic than it appears at first glance.

Leveraging Her Personal Brand for Instant Shelf Appeal

Khloé has spent years cultivating a public image centered around wellness, fitness, and personal transformation. That makes a Khloé Kardashian popcorn brand—especially one marketed as a healthier snack—feel surprisingly aligned with her long-term narrative.

Consumers already trust her recommendations in beauty and lifestyle, so extending that trust to food products is a natural next step. Celebrity-backed snacks often struggle with credibility, but Khloé’s established reputation gives her a head start. This built-in trust translates into immediate shelf appeal and faster adoption among curious shoppers.

A Smart Play for Passive and Scalable Income

One of the most interesting aspects of this move is how it fits into Khloé’s broader financial strategy. A Khloé Kardashian popcorn brand doesn’t require her to be physically present to generate revenue, making it a scalable and semi-passive income stream. Once distribution deals, manufacturing, and marketing pipelines are in place, the product can sell around the clock.

This is the kind of business model that helps celebrities—and everyday entrepreneurs—build wealth that compounds over time. For readers focused on debt payoff and financial independence, this is a reminder that scalable income streams can dramatically accelerate long-term goals.

Retail Partnerships That Expand Her Reach Overnight

Khloé’s popcorn isn’t quietly launching on a small website—it’s rolling out through major retailers that instantly put it in front of millions. A Khloé Kardashian popcorn brand landing in national chains gives her a distribution advantage most new snack brands can only dream of.

Retail partnerships also create credibility, signaling to consumers that the product has passed quality and demand thresholds. This kind of visibility can turn a niche product into a household name within months. For Khloé, it’s another example of using her influence to secure deals that multiply her earning potential.

A Case Study in Celebrity Wealth Diversification

Khloé’s net worth—estimated at around $65 million—didn’t come from one business alone. The Khloé Kardashian popcorn brand is just the latest addition to a portfolio that includes television, fashion, endorsements, and digital ventures.

Diversification is a key strategy for protecting and growing wealth, and Khloé demonstrates how to do it effectively. Instead of relying on a single industry, she spreads her risk across multiple sectors with different revenue cycles. This approach is something everyday consumers can learn from, especially those working toward financial stability or debt reduction.

A Final Thought on Khloé’s Unexpected Wealth Move

Khloé Kardashian’s popcorn venture may seem like a fun celebrity experiment, but it’s actually a masterclass in strategic wealth-building. The Khloé Kardashian popcorn brand blends timing, branding, and consumer psychology in a way that positions her for long-term financial gain. Her ability to turn everyday products into high-performing assets is a reminder that opportunity often hides in plain sight. For anyone working to improve their financial future, Khloé’s pivot is a nudge to think creatively about income potential. Sometimes the most surprising ideas turn out to be the most profitable.

What do you think about Khloé’s unexpected popcorn empire—smart business move or celebrity overreach? Share your thoughts in the comments.

What to Read Next

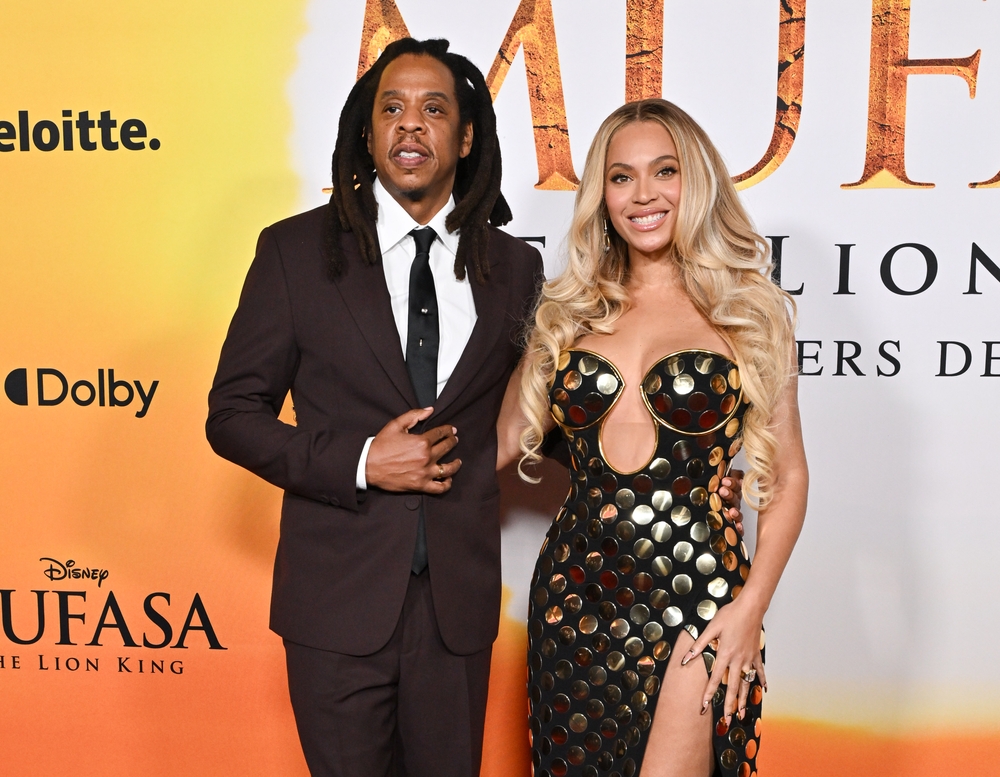

Top 5 American Women Ranked Based On Their Net Worth (#1 Will Surprise You)

11 Celebrities Who Never Wasted Their Money on Plastic Surgery

8 Famous Women Everyone Still Swears Married For Money

9 Small Business Owners Who Used Celebrities to Build a $50M+ Empire

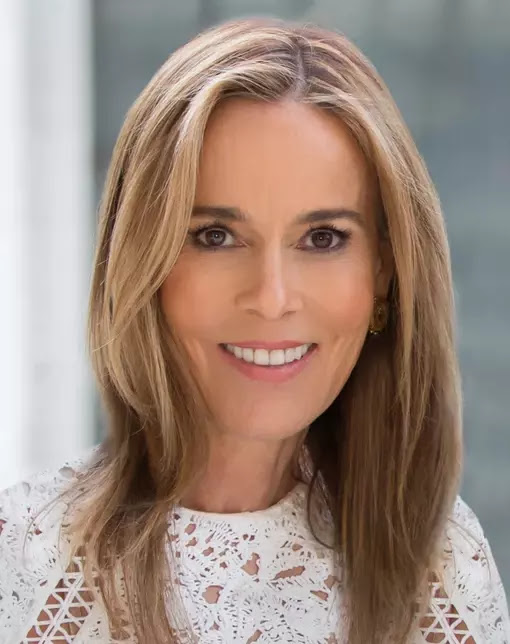

Emma Grede: The Fashion Mogul Behind Good American & Skims Whose Net Worth Tops $300M